Product

OgmaCore: Fundamentally Change How Credit Underwriting Is Done.

Overview

OgmaCore is a next-generation underwriting development environment (UDE) for banks, purpose-built to automate credit processes beyond traditional loan origination (LOS) systems.

Unlike traditional loan origination systems, OgmaCore provides a single, customizable workspace where customers, analysts, lenders, credit officers, and loan committees build, review, and monitor credit decisions with embedded automation at every step.

Key Features

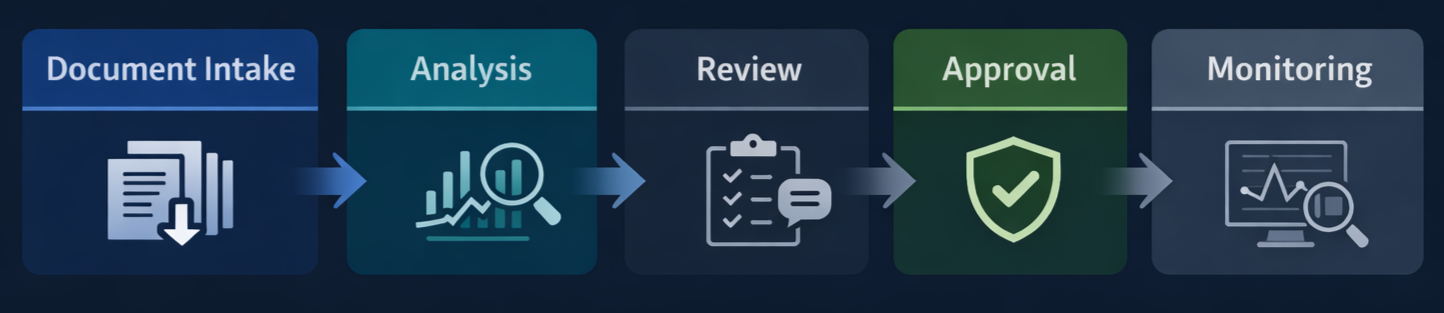

- End-to-End Underwriting Automation – Move commercial and consumer credit applications from document intake to approval readiness in as little as one day through embedded automation.

- Customization – Configure both the underwriting workflows and the individual credit processes to match your bank's policies and format, allowing each bank to build, review, and approve credits exactly how they need.

- Embedded Document Sourcing – Automatically tracks and highlights the origin of all data and documents used in the underwriting process, giving full data transparency.

- Document Tracking & Upload – Securely collect, store, and manage all borrower documentation in one place. Automate document retrieval and ensure compliance and audit readiness effortlessly.

- Portfolio Risk Analytics – Assess and monitor risk across your loan portfolio with dynamic, data-driven insights.

- Live Monitoring – Stay informed with real-time updates on borrower behavior, portfolio performance, and potential risks.

Why OgmaCore?

- Significantly accelerates the loan process from document intake to credit decision.

- Reduces administrative burden with automated workflows.

- Improves borrower experience through streamlined processes.

- Enhances portfolio management with actionable, live insights.

Deployment & Security

- Evidence & Traceability — Designed for review: clear data lineage, repeatable calculations, and outputs suitable for audit and model governance workflows.

- Configurable Access Model – Supports secure browser-based access to align with institutional security policies.

Typical Users and Respective Feature

- Credit Analysts: Automated Underwriting Tools to Enhance Efficiency and Consistency.

- Borrowers: Interactive After-Hours Document Uploads, Digital Customer Forms, and Full Loan Lifecycle Monitoring to Materially Reduce Manual Touchpoints.

- Lenders: Automatically Requests Customers for the Necessary Documents.

- Loan Officers & Loan Committee: Enables Credits to Move Through Feedback, Revision, and Approval Cycles Automatically.

Transform your credit operations with OgmaCore.

OgmaCore underwriting workflow